Sample Chart Of Accounts: An Entire Information For Small Businesses

That a part of the accounting system which incorporates the steadiness sheet and earnings statement accounts used for recording transactions. The COA is usually set as much as show data within the order that it seems in financial statements. That implies that steadiness sheet accounts are listed first and are followed by accounts in the earnings statement. The reports play a crucial role in both the monthly financial management and the annual financial review process.

Can The Structure Of A Chart Of Accounts Differ Considerably Between Industries, And If So, How?

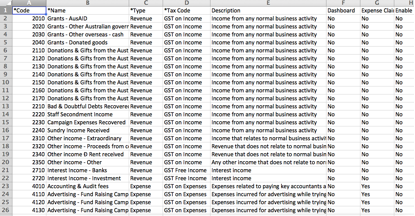

The specific accounts and subcategories will range relying on the business sort and trade. It offers an in depth framework for analyzing past transactions, invaluable for projecting future monetary efficiency. The structure of the COA also promotes financial transparency and accountability, fostering belief amongst stakeholders. A chart of accounts is a listing of all the individual monetary accounts a business uses.

Tips On How To Structure Your Chart Of Accounts

The advantage of approach B is that it makes the job of managing an organization simpler. As An Alternative of getting to determine which normal will work greatest, they both apply the nationwide GAAP or go to prison. In the end, management can decide what works best for them and their company. Although it is an IFRS/US GAAP advisory firm, the owner of this web site is a authorized entity domiciled within the Czech Republic.

Account Kind

Small businesses commonly use three-digit numbers, whereas large businesses use four-digit numbers to allow room for additional numbers because the enterprise grows. Accounts payable (AP) automation software plays a big position in enhancing the administration and optimization of a chart of accounts. It automates routine accounting duties, decreasing the chance of handbook errors and saving time. This automation extends to the categorization of transactions, which boosts data accuracy and ensures financial records are constantly reliable.

- No, but it’s thought-about needed by every kind of firms in search of to categorize all of their transactions so that they can be referenced rapidly and easily.

- Typically, all of them comply with the essential construction described beneath.

- What’s important is to use the same format over time for the consistency of period-to-period and year-to-year comparisons.

The chart of accounts is a tool that lists all the monetary accounts included in the monetary statements of a company. It supplies a approach to categorize all the financial transactions that a company conducted during a particular accounting period. Underneath this column, we point out the financial statement impacted by the accounts. The asset-liability and equity accounts have an effect on the balance sheet, whereas the revenue and expense accounts reflect adjustments in the earnings assertion. A chart of accounts is a document that numbers and lists all the monetary transactions that an organization conducts in an accounting period.

Intuit does not https://www.simple-accounting.org/ endorse or approve these services, or the opinions of those firms or organizations or individuals. Intuit accepts no accountability for the accuracy, legality, or content on these websites. Present liabilities are any excellent funds which may be due inside the year, whereas non-current or long-term liabilities are payments due more than a 12 months from the date of the report.

An account might simply be named “insurance offset.” What does that mean? The bookkeeper would have the ability to tell the difference by the account number. An asset would have the prefix of 1 and an expense would have a prefix of 5.

But experience has proven that the most typical format organizes info by particular person account and assigns each account a code and description. What’s important is to make use of the identical format over time for the consistency of period-to-period and year-to-year comparisons. As you’ll have the ability to see from the two accounting numbering examples, the systems are completely different. Sage UK makes use of a different numbering system starting from 0010 and ending at 9999.

Revenue is commonly the category that business owners underutilize the most. Some of the most common forms of income or earnings accounts embrace sales, rental, and dividend earnings. This numbering system helps bookkeepers and accountants keep observe of accounts along with what category they belong two. For occasion, if an account’s name or description is ambiguous, the bookkeeper can merely look at the prefix to know precisely what it’s.

Naturally, you do not have to make use of all of these accounts in your bookkeeping. The proper combination of instruments will simplify bookkeeping and support your chart of accounts as your small business evolves. Accurate revenue tracking ensures reliable financial reporting and is important for evaluating profitability and planning development. In this information, we’ll stroll you through the way to construction your chart of accounts in a way that works for your small business, helps smarter decision-making, and leaves room for progress. QuickBooks Online routinely sets up a chart of accounts for you primarily based on your business, with the choice to customise it as wanted.

Mismanagement of cash move is cited as the first purpose 82% of small businesses fail. A thoughtful chart of accounts also plays a important position in budgeting and monetary planning. It allows you to track spending patterns, monitor income streams, and determine financial trends over time. This helps you plan extra successfully for future progress, manage cash flow, and prepare for each opportunities and risks.